Some promising A2J news from the Hoosier state.

Folks, this update requires a bit of context.

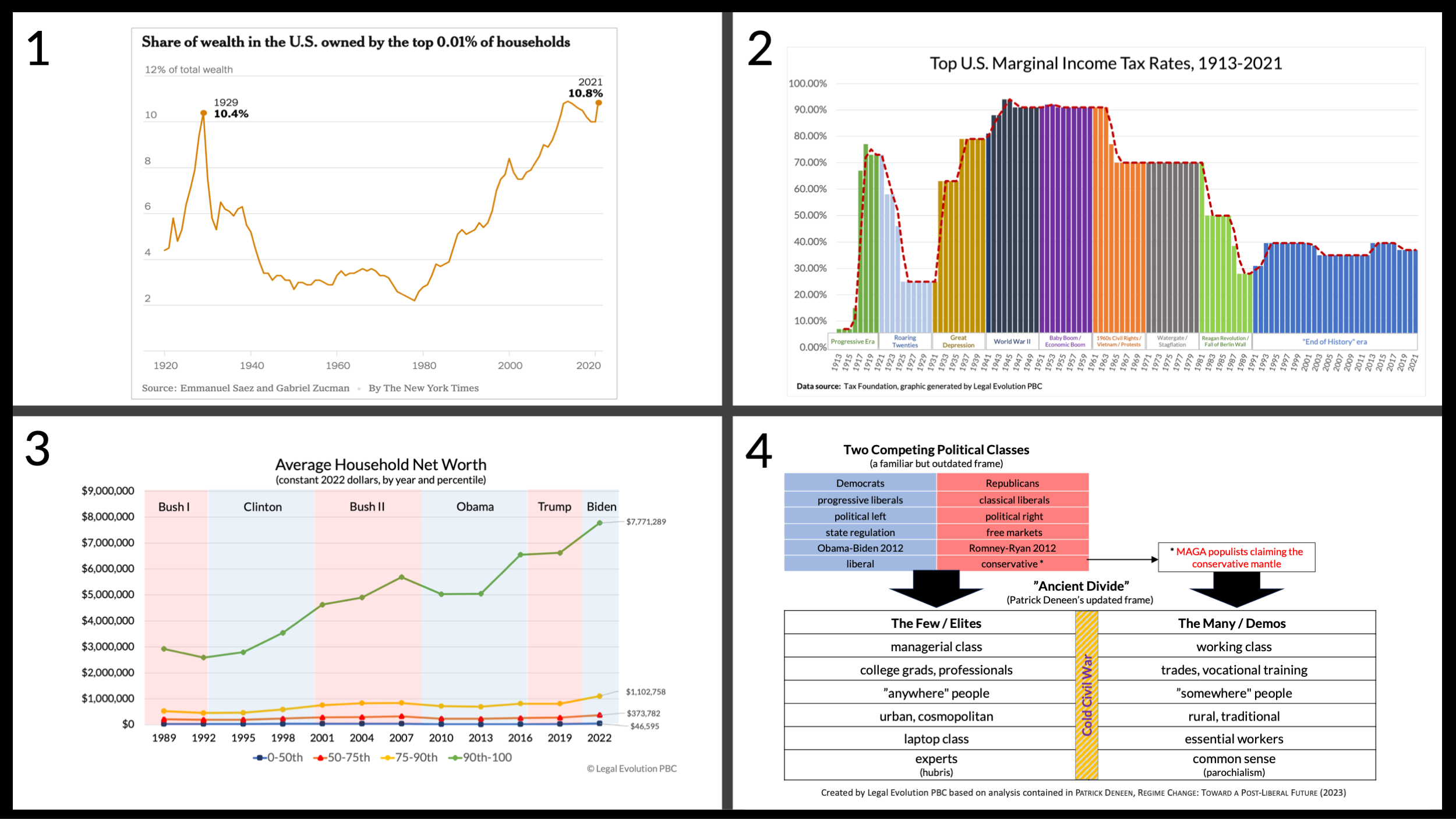

As regular LE readers know, back in 2022, the content of Legal Evolution began to shift as I wrote a series of essays seeking out the root causes of our present-day social, political, and economic strife. See Posts 312 (original Gilded Age lawyers), 319 (US policies leading to wealth inequality and the “End of History” illusion), 321 (empirically based theories of national decline). As a law professor who teaches the ABA-required legal ethics course, I found this subject matter impossible to avoid. Cf. ABA Preamble ¶ 6 (“[A] lawyer should cultivate knowledge of the law beyond its use for clients [and use it to] … further the public’s understanding of and confidence in the rule of law … because legal institutions in a constitutional democracy depend on popular participation and support to maintain their authority.”).Continue Reading Update on A2J in Indiana, including work being done at IU Maurer Law (357)