The legal profession appears to be on autopilot.

This post is for legal market analysts who are looking for updated and reliable data on the current legal services market. Collectively, its eight graphics reveal several themes that ought to give us pause, as we (the legal profession) may not have unlimited runaway to focus on strategies related to income and profit.

Most of the underlying data come from the Economic Census, which is a detailed ongoing survey of US businesses conducted every five years (years ending in 2 and 7) by the US Census Bureau. Because of the size and scope of the data collection effort (it’s a census, not a sampling), it takes the full five-year cycle to complete the analysis and release the findings. The final—and in my view, the most interesting—installments were published last fall.

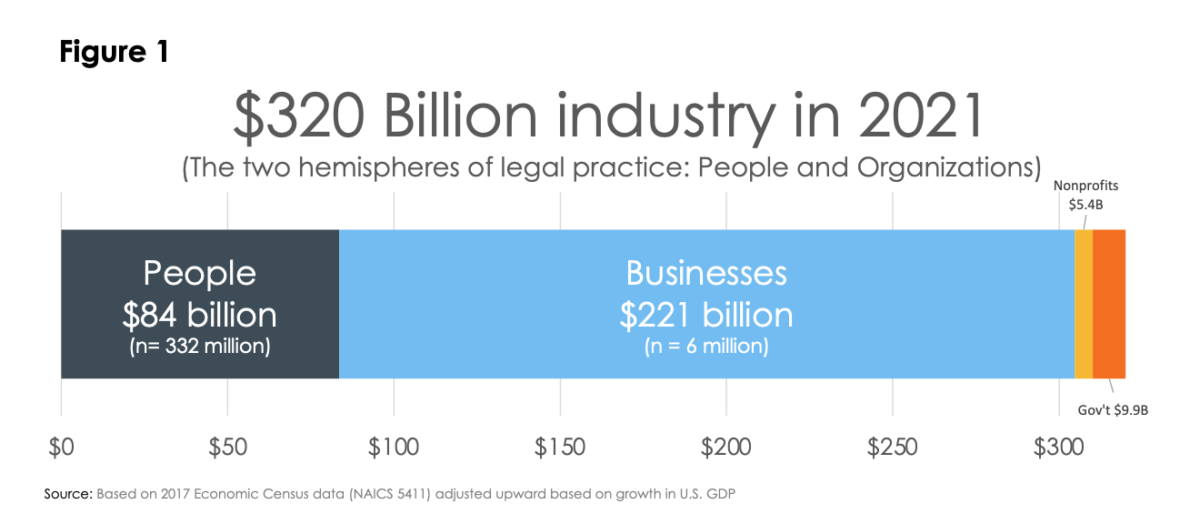

Figure 1 (above) is based upon “Class of Customer” data, breaking down customers into several categories: Individuals, Businesses, Government (Federal, State, Local), and Nonprofits. Class of Customer data is very valuable because it maps onto the two-hemisphere framework developed by Jack Heinz and Edward Laumann in the seminal Chicago Lawyers I study. See Chicago Lawyers: The Social Structure of the Bar (1982) (popularly known as Chicago Lawyers I); Post 037 (discussing study).

In Chicago Lawyers I, which was based on a randomized sample of 800 lawyers drawn in 1975, Heinz and Laumann found that roughly half served individuals while the other half served organizational clients (business, governments, unions, etc.), with very few serving a mixture of both. Further, the “two hemispheres” of practice—people and organizations—were (and still are) strongly correlated with lawyer income and various measures of prestige, such as law school attended and bar association membership. Thus, Heinz and Laumann concluded, “Only in the most formal senses, then, do the two types of lawyers constitute one profession” (p. 384).

Twenty years later, an expanded group of researchers replicated the study in what came to be known as Chicago Lawyers II. See Heinz et al., Urban Lawyers: The New Structure of the Bar (2005). Although the Chicago bar was still very much segmented by type of client, lawyers serving people had entered a period of stagnation, with lower incomes and declining volumes of work. In contrast, lawyers serving organizations (mostly those working in large law firms and in-house legal departments) grew in both numbers and income.

The Figure 1 Class of Customer data is basically a continuation of the Chicago Lawyers II storyline, with organizational clients generating nearly 75% of legal services industry revenue.

Digging deeper, Figure 2 compares the breakdown of 2007 Class of Customer data (the first year it was part of the Economic Census for professional services) with 2017. To ensure that the comparison is focused on law firms rather than various types of legal service vendors, I limited the analysis to Offices of Lawyers, which (as discussed in greater detail below) accounts for over 95% of the broader legal services market as defined by the US Census Bureau.

- Businesses: $150.1 billion to $197.3 billion (+31.0%).

- Gov’t: $7.5 billion to $9.1 billion (+20.7%)

- NonProfits: $3.4 billion to 5.1 billion (+49.3%)

- People: $66.3 billion to $72.0 billion (+8.6%)

The $5.7 billion increase in the People Law sphere between 2007 and 2017 is better than the data reported for 2012, which showed a decline in total PeopleLaw dollars. See Post 037. Yet, focusing on change over the full decade, between 2007 and 2017, the U.S. population grew from 298 million to 325 million people (+9.1%). See Macrotrends, US Population, 1950-2022. Thus, on a per capita basis, the average PeopleLaw budget for legal services was $222.40 in 2007 compared to $221.50 in 2017—a decline of 90¢. Because the relatively wealthy spend more as needed to solve our legal problems (top 10-25% of income earners, likely most LE readers), it is near certain that a growing proportion of people are, with each passing year, being priced out of access to legal services.

So today, when we are talking about the legal services market, we are mostly talking about lawyers serving businesses, and more so with each passing year. As I’ve noted in earlier posts, see, e.g., Posts 037, 226, this is a slow-moving cancer that is likely connected to the alarming rise we are experiencing in right-wing populism. Cf Gillian Hadfield, Rules for a Flat World at 79 (2017) (“People who feel as though the rules don’t care about them don’t care about the rules”).

As discussed in greater detail below, the legal services market. as tabulated by the Census Bureau and summarized in Figures 1 and 2, is but a subset of a larger legal market that is much more difficult to measure.

Legal profession within the legal services industry

When the Census Bureau collects data on the legal services market, it relies upon the North American Industry Classification System (NAICS), which is a taxonomy of the US economic activity originally introduced in 1997.

The primary virtue of NAICS is that it enables us to track change over time. Its primary constraint, however, is that the categorization system is at risk of getting out of step with the facts on the ground. This is particularly true in the legal industry circa 2022, as NewLaw and LegalTech have entered a period of rapid growth. See, e.g., Post 231 (comparing legal industry to auto industry circa 1905); Post 255 (discussing newest unicorns in Legal Tech); Post 256 (discussing explosive growth in Contract Tech). Very little of this activity is classified as “legal” by the Census Bureau.

Under the NAICS, the largest category for legal services (as opposed to other professional services sectors) is the four-digit NAICS 5411. In 2017, revenue for 5411 (Legal Services, All Establishments) totaled $297.7 billion dollars, which I adjusted upward in Figure 1 to $320 billion based upon an increase in GDP between 2017 and 2021. See Federal Research Economic Data (FRED). Thus, $320 billion is an estimate, but likely a reasonable one.

The largest component part of 5411, which accounts for 95.2% of the legal services industry, is Offices of Lawyers (NAICS 541110). The rest of 5411 consists of Title Abstract and Settlement Offices ($9.5 billion in receipts, NAICS 541191), which reflects the fact that lawyers no longer preside over real estate closings in most jurisdictions, and All Other Legal Services ($4.7 billion, NAICS 541199), which is a grab bag of ancillary services (temp services, jury consultants, expert witnesses, service of process vendors, etc.) that mostly serve organizational clients (82.9%).

Thus, the NAICS data basically reflects a legal services industry mostly comprised of law firms—i.e., the legal profession. Most of the profession is for-profit, though slightly more than 1,000 of the 163,655 firms in NAICS 541110 are nonprofits (basically legal aid organizations). These firms account for $3.8 billion of the total market.

Revenue is up

Focusing on law firms, Figure 3 summarizes the change in revenue over time for Offices of Lawyers.

1. Unclear where ASLPs fit in the data

First, one of the limitations of Census data is that Offices of Lawyers does not neatly track the profession’s own conception of the practice of law, including the demarcations created by the Rule 5.4 prohibition on nonlawyer ownership. Specifically, many large Alternative Legal Service Providers (ALSP, aka NewLaw) are categorized as Offices of Lawyers (541110). See Henderson, “How managed services are building systems for corporate legal work,” ABA Journal (June 2017).

From a purely economic perspective, this is probably a correct characterization—many ALSPs employ literally hundreds of lawyers. This is permissible under the ethics rules because ASLPs are part of the massive lawyer-to-lawyer (L2L) economy in which in-house or law firm lawyers are presumed to supervise the work. See Henderson, Legal Services Landscape Report (State Bar of California, July 2018) (discussing how Rule 5.4 has been applied to work for large corporate clients). Yet, it creates some uncertainty over what fraction of revenue growth may be attributable to the emerging ASLP market, which earlier this year was estimated to be $14 billion globally. See Thomson Reuters & Georgetown Center on the Legal Profession, Alternative Legal Service Providers 2021: Strong Growth, Mainstream Acceptance & No Longer an “Alternative” (2021).

NAICS also has the limitation of likely excluding ALSP work performed by several thousand lawyers working inside the Big Four accounting firms, as they have their own NAICS classifications and, in the US, are very clear about not engaging in the practice of law. At least for 2017, we can be confident that traditional law firms are driving the vast majority of the $35 billion growth in revenue. But going forward, the inclusion or exclusion of ALSP work is going to muddy the waters of how we accurately measured the market for legal services, as Office of Lawyers as defined by the NAICS is increasingly out of step with how the industry is evolving.

2. Two decades of flat law firm employment

A second wrinkle on the seemingly steady lockstep growth in Figure 3 is that revenue is not necessarily the best indicator of overall industry health. For example, even though revenues may be up, as shown in Figure 4 below, overall law office employment has been stagnant for nearly two decades.

As shown in Figure 5 below, the number of law graduates entering private practice has been flat for the last several years, with every category of law firm size still below pre-recession hiring levels.

Leverage inside large firms is getting older

One potentially encouraging trendline in Figure 5 is that entry-level hiring in 500+ law firms is finally approaching its pre-recession highwater mark of 5,193 new hires. Yet, the universe of large law firms is not a static category, as firms continue to merge in order to better position themselves for work from large corporations who increasingly desire a national or global platform.

Figure 6 below reveals how the size of the 500+ lawyer universe has expanded since the heady pre-recession days of 2007 and 2008.

This past week, Milbank announced its intention to increase its associate scale, with first-year starting salaries rising from $205,000 to $215,000. See Patrick Smith, “Milbank Boosts Associate Pay Scale For The Second Time In A Year,” Law.com, Jan 20, 2022. Yet, Milbank is part of a much smaller cohort of 500+ lawyer law firms that have the market power to require their clients to accept a business model that relies heavily on expensive associate leverage.

In contrast, what is happening at most large firms is an increased reliance on older, experienced lawyers—counsel, nonequity partners, and staff attorneys who generate good margins for firms with virtually no client pushback. In my view, these trendlines provide little basis for a more resilient law firm sector. Indeed, in terms of growth and profitability, there is a good possibility that for law firms outside the Super Rich, 2021-2022 may be as good as it gets.

What would improve this situation for young lawyers is for corporate counsel to acknowledge their impact on the talent supply chain, working with large firms and other legal service providers to develop apprenticeship programs that offer a sane and sustainable training wage during either the third year of law school and/or the first year of practice. In addition to widening the door into practice, such an approach could also improve diversity and reduce student debt loads.

Building this type of infrastructure for the legal profession requires leadership and coordinated effort and resources from some very rich lawyers working for very large corporations. But that’s the price of being a true profession.

Heavy reliance on large corporate clients

According to the estimate in Figure 1, organizational clients account for $236 billion of the current legal service market as defined by the U.S. Census Bureau. Further, that amount is spread over approximately 6 million businesses. See US Census Bureau, 2017 Statistics on US Businesses (SUBS). Obviously, some businesses spend hundreds of millions on legal services while in a good year, many spend zero. Yet, what is the likely breakdown by size of corporate client?

Earlier research with Evan Parker revealed that outside counsel spend for large corporate clients was an average of 0.3% of company revenues, albeit with wide variations by industry. See Henderson & Parker, “Your Firm’s Place in the Legal Market,” Am Law (Dec 2015). Drawing upon this benchmarking data, Figure 7 is an estimate of spending on outside counsel based on a sliding scale of 0.3% for the Fortune 1000, which have the benefit of legal departments to handle more common and routine legal work, to 1.2% for smaller companies (< $25 million in revenue and thus much less likely to have in-house counsel). The logic here is simple: the smaller the company, the greater the reliance on outside law firms to manage legal needs.

Based on the above assumptions, the average outside counsel budget for the 98,000 medium-sized companies is a remarkable $863,000 per year. For the 1,500 companies with > $2.5B in revenue, the average budget is $38.9M per year. In contrast, the average annual legal budget for small businesses (<$25M in revenue) is a meager $13,300, which requires a law firm business model that is focused on volume rather than a steady book of corporate clients. Obviously, most of us would prefer the steady book. Remarkably, none of this math accounts for the enormous ongoing surge in the number of in-house lawyers, which is a segment of the bar entirely outside the NAICS 5411 Legal Services universe. See Post 262 (reporting more lawyers working in-house in the US than working in a domestic office of AmLaw 200 law firms).

I don’t think the legal profession, including those of us working in the legal education industrial complex, has come to grips with the reality that we increasingly owe our livelihoods to the legal needs of very large businesses in which the vast majority of lawyers work as technicians rather than trusted advisors.

To illustrate my point, consider Figure 8, which is an update of a graphic originally presented in Post 067 (discussing “our journey to Big”). In effect, Figure 8 summarizes the composition of the entire US economy.

Autopilot

We got here largely by accident, as most lawyers are (somewhat understandably) consumed with the daily obsession of earning a living. In effect, we’re flying on autopilot.

But let’s be honest—a profession that does not measure itself is not a profession engaged in any type of meaningful self-regulation. We have failed to build the necessary infrastructure to study and understand our past, present, and future. In addition to harming incoming lawyers—who, unlike the medical professionals, lack established pathways to competence and financial security—we lack the perspective, detachment, and professional cohesion necessary to keep the legal system operating in the long-term public interest.

I am not sure this can be fixed without learning the lessons that come from a truly humbling crash. I am still digesting the data. I need to give it some more thought. I hope you will too.