A crowded, chaotic landscape in love with the future.

The opening graphs of Richard Susskind’s Tomorrow’s Lawyers (2nd ed. 2016) predict the revolution that is now underway:

This book is a short introduction to the future for young and aspiring lawyers.

Tomorrow’s legal world, as predicted and described here, bears little resemblance to that of the past. Legal institutions and lawyers are at a crossroads, I claim, and will change more radically in less than two decades than they have over the past two centuries. If you’re a young lawyer, this revolution will happen on your watch. (p. xvii)

Indeed, only a revolution could explain the above “market map,” which reflects literally hundreds of point solutions for a rapidly expanding one-to-many legal marketplace.

In this post, I make the claim that I’ve seen a very similar fact pattern before (in my pre-law research on the auto industry) and that the future of the legal industry is likely to play out differently than the visions that animate so many legal entrepreneurs and VC-PE funders.

Regarding the similar fact pattern, there are remarkable parallels between today’s crowded, chaotic legal industry and US automotive manufacturing in the late 19th and early 20th century. Indeed, the first gas-powered commercial vehicle launched in the US in 1893 (the Duryea Motor Wagon Company of Springfield, Massachusetts). Within two years, more than 1,900 companies would be producing more than 3,000 makes of cars. See John B. Rae, “Why Michigan?”, in The Automobile and American Culture at 6 (David Lanier Lewis, David Levering Lewis, & Laurence Goldstein, eds. 1983).

All of these carmakers were right about one thing—cars were the future of US transportation. But most were wrong that consumers would be buying their cars.

As discussed in greater detail in the body of this post, the auto industry is a very powerful metaphor to understand the evolution of the legal market, particularly the energy and dynamism of the one-to-many legal ecosystem. Cf. Post 195 (Dan Currell making the case that auto industry’s lean production methods reveal significant innovation opportunities for law firms); Post 159 (Jason Barnwell arguing that too much knowledge work resembles a chaotic, disorganized factory and that knowledge work “should be designed”).

Yet, on several dimensions, the auto industry is an imperfect metaphor. Thus, to avoid being led astray, it is worth understanding the metaphor’s boundaries and limitations. Relatedly, and no less important, many lawyers have a viscerally negative reaction to any suggestion that legal work, or even facets of legal work, can be mechanized or industrialized. Therefore, in my talks to lawyers—particularly early or late majority audiences, which is most law firms—I tend to steer clear of auto industry comparisons. Yet, in all candor, I believe this analysis is powerful and important. Thus, I’m forging ahead with the following proviso: if you are one of the many lawyers with a strong disdain for industrial metaphors, I suggest that you get your emotions under control. Otherwise, you’ll struggle to understand the future of your (our) profession. Cf. Preamble to ABA Model Rules ¶6 (as “a member of a learned profession, [we] should cultivate knowledge of the law beyond its use for clients”).

Post 231 is organized into two parts. Part I discusses the similarities and parallels between the automotive industry, which includes stories of status quo-driven complacency that is now giving way to the transformative potential of one-to-many legal products and solutions. Part II, which is significantly shorter, examines the dissimilarities that limit the metaphor’s scope and traction. What remains, however, suggests a harder rather than an easier path for legal innovators.

I. Similarities and Parallels

This story makes more sense when we start in the middle (present) and then look backward. This is because our frame of reference on cars is anchored in events that are familiar to most consumers and observers of business.

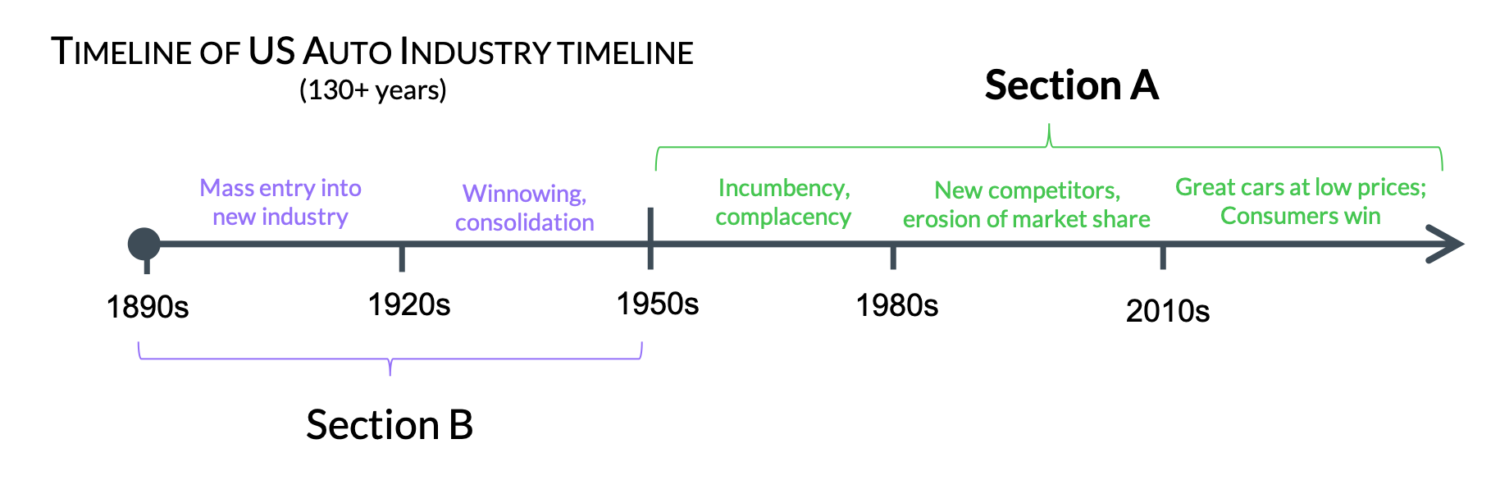

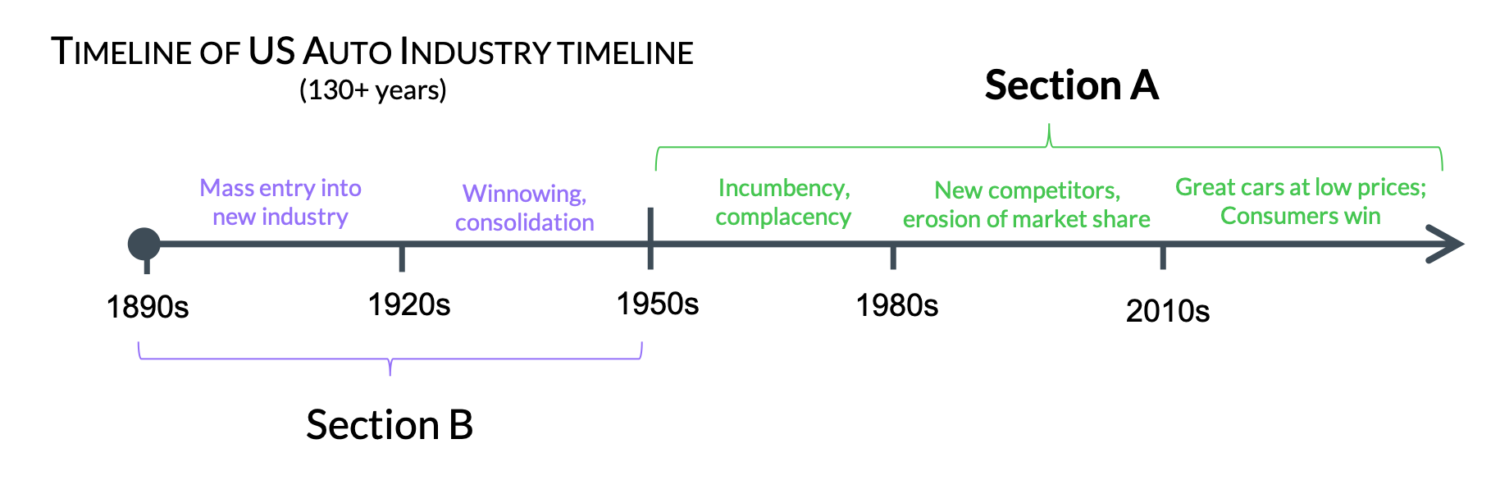

Section A is about the recent history–the challenges and pathologies of a mature US auto industry and how it was eventually transformed by lean production methods pioneered by Japanese carmakers, with the vast majority of the spoils flowing to consumers. In some respects, BigLaw’s lucrative one-to-one consultative services model is akin to the privileged market position of the Big Three during the 1960s and ’70s. In short, “Why change?”

Section B looks backward a full century to the brutal competition that winnowed 1,900 companies down to a small handful and ultimately the Big Three. This is a story about standardization, economies of scale, R&D, and picking and executing the right strategy–i.e., one that results in sizable profits, thus enabling management to stay in a game that ultimately ends in consolidation. It’s also the story that has the greatest parallel with the emerging one-to-many legal landscape–i.e., our future.

The timeline below summarizes the core Part I narrative.

A. Recent auto industry history (1950s to present)

My research as a law professor focuses on the legal profession and the legal industry. But 25 years ago, as I was finishing my undergraduate degree, I worked as an RA to Susan Helper, one of the nation’s leading automotive economists.

One of our biggest projects was a series of interviews with Tier 2 and Tier 3 suppliers in Northeastern Ohio, the historical stomping grounds of Ford and General Motors. Professor Helper wanted to assess the extent to which the U.S. Big Three supply chains had adopted Japanese Kaizen principles (translated as “change for the better”) to better manage and allocate environmental risk.

Specifically, were buyers and suppliers sharing information in search of the best, most sustainable long-term solution (the Kaizen approach)? Or were buyers relying on their monopsony power to force year-over-year pricing discounts regardless of the short- to medium-term impact on suppliers (“sweating competition” approach)?

There was no ambiguity in our findings. Rather than telling us stories of virtuous buyer-supplier collaboration, we heard about the importance of controlling costs in order to stay in business. In many cases, the companies extolled their low labor costs, which were achieved through union-busting tactics. Not surprisingly, the suppliers’ biggest challenge was often finding enough tool-and-die makers to keep the factories operating smoothly, as the emphasis on cost control had undermined the ability of trade unions to train these highly skilled workers. As their numbers evaporated, the entire regional supply chain was growing weaker.

Over the last 15 years or so, a similar adversarial dynamic can be observed between large corporate legal departments and their outside law firms, as clients started refusing to pay for (admittedly underskilled) junior associates. BigLaw responded by slashing entry-level hiring. See Henderson, “Three Generations of U.S. Lawyers: Generalist, Specialist, Project Manager,” 70 Md. L. Rev. 373, 386-88 (2011). In turn, the remaining entry-level jobs disproportionately flowed to students at T14 law schools. See Post 114 (Evan Parker presenting data). Elite general counsel now routinely lament the lack of diversity available to work on their matters. See, e.g., Staci Zaretsky, “General Counsel Will Hit Biglaw Firms Where It Hurts If They Don’t Increase Diversity ASAP,” Above the Law, Jan 28, 2012. Yet, as a group, they are often too busy, too rich, and too important to bother with root-cause analysis. Cf. Henderson, “How to Solve the Legal Profession’s Diversity Problem,” PD Quarterly (Feb 2016) (presenting overwhelming evidence of a “systems problem” that can be fixed).

The underlying narrative here is one of incumbency—both in large firms and large legal departments—that eventually gives way to complacency. Why innovate when you can just throw around your prestige and market power to get what you want?

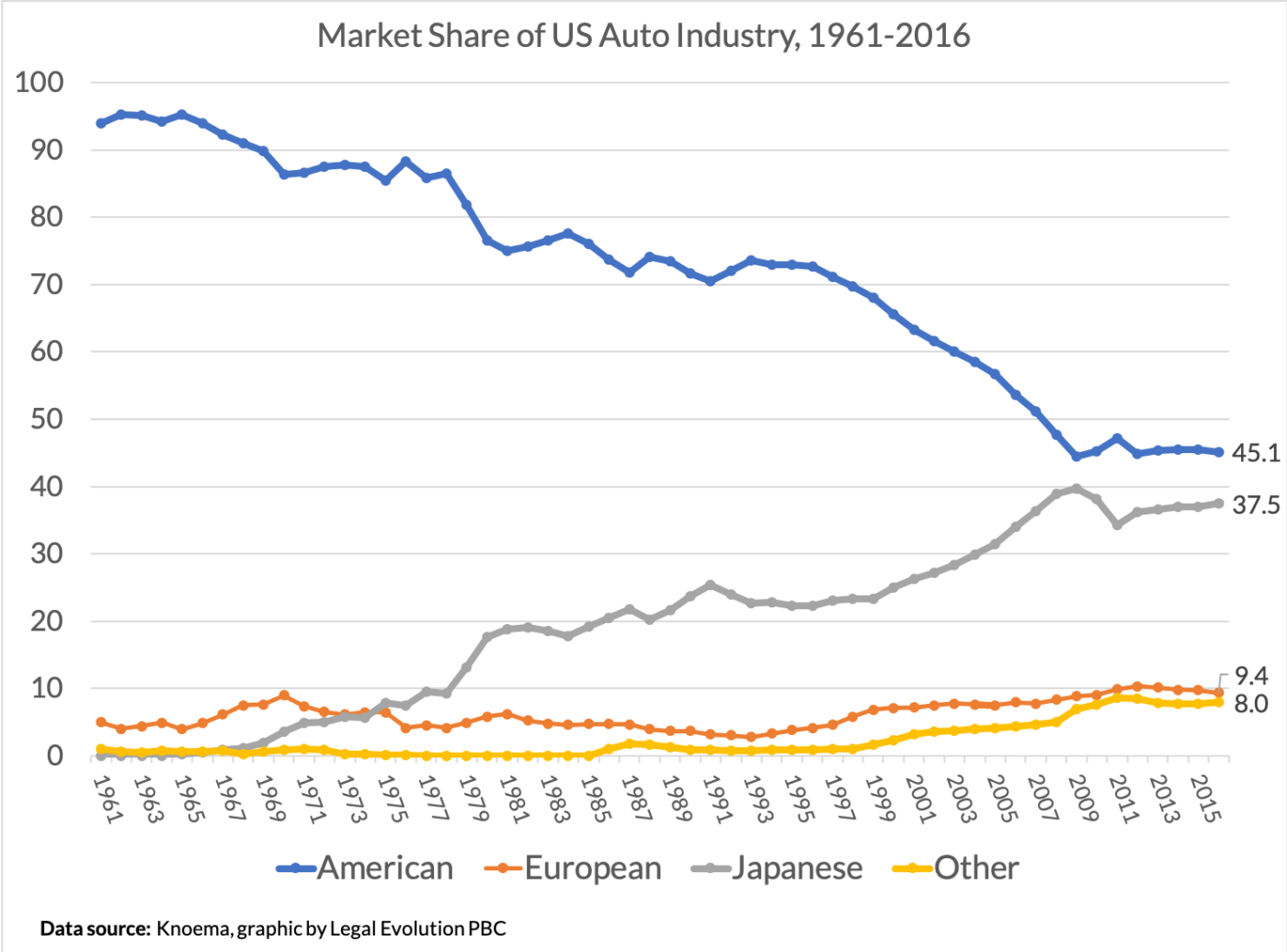

Starting in the 1960s and 1970s, foreign carmakers began to make inroads in the US market with smaller cars selling at lower prices. The fat and happy US automakers largely ignored them, primarily because it was hard to make money selling smaller, lower-priced cars. Yet, the Japanese automakers soon proved that lower prices were not synonymous with lower quality. In turn, this enabled companies such as Toyota, Honda, and Mazda to climb the value chain, eventually becoming fierce competitors in all market segments.

The graphic below shows the trendlines.

Over the last three decades, we’ve witnessed a similar reallocation of legal work away from large law firms and toward corporate legal departments. Below is a graphic that has appeared in earlier Legal Evolution posts. See, e.g., Post 003 (reporting on massive insourcing of corporate legal work); Post 126 (discussing human capital needed for emerging one-to-many legal sector).

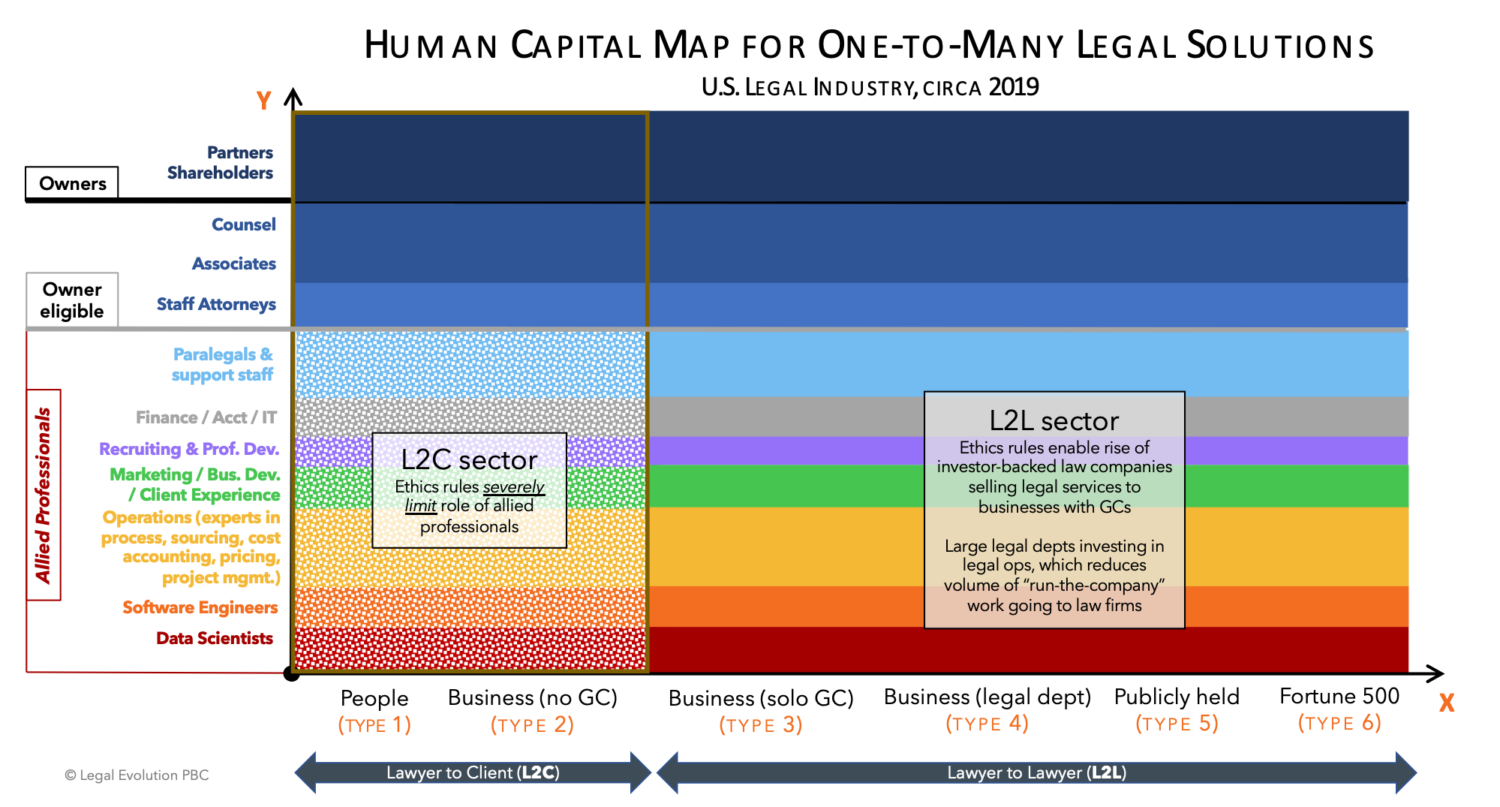

Over the last three decades, we’ve witnessed a similar reallocation of legal work away from large law firms and toward corporate legal departments. Below is a graphic that has appeared in earlier Legal Evolution posts. See, e.g., Post 003 (reporting on massive insourcing of corporate legal work); Post 126 (discussing human capital needed for emerging one-to-many legal sector).

Remarkably, there are now more US lawyers working in-house (~108,000) than are working domestically at AmLaw 200 law firms.

What is likely happening is a gradual segmentation of the corporate legal market in which more routine and operational legal work–the bulk of corporate legal work–is being insourced to avoid exorbitant law firm rates. Another complementary explanation is that corporate clients have become much larger, see Post 067 (presenting data), thus making it more advantageous to embed lawyers inside business units, thus reducing communication overhead within profoundly complex organizations. Yet, regardless of the causal driver, what remains for law firms is more specialized legal work.

This surfeit of more specialized work explains where we are today: law firms enjoying extraordinarily high profits during a prolonged period of no growth. See Post 216 (Jae Um documenting high BigLaw profits amidst low growth in volume of legal work). It also explains the growth of Alternative Legal Service Providers (ALSPs), which are poised to profit from relentless disaggregation and commoditization of legal work. See Thomson Reuters Institute, Alternative Legal Services Providers 2021 at 4 (reporting a $14 billion ALSP market that is growing at 15% per annum); Post 013 (Alan Bryan of Walmart predicting that ALSPs will take market share).

Although BigLaw/corporate counsel of today and the Big Three of the 1960s to the 1980s were both lulled into a sense of complacency, the parallelism is far from perfect. More on that in Part II. That said, one of the most important points of this analysis is the consequences of complacency may not materialize for one or more generations. U.S. automakers experienced a 50-year slide in market share before they finally staunched the bleeding after the 2008-2009 financial crisis. Perhaps a similar timeline applies to the legal sector.

What we do know is that large law firms are aging, as the work that was formerly used to train junior lawyers—at a substantial profit to the firms—has been insourced to legal departments and ALSPs, which generally do not hire out of law school. At least in the short to medium-term, law firms can profit from new forms of leverage composed of senior counsel and nonequity partners, shifting their human capital strategy from “up and out” to “up and over.” In the long run, however, this approach eventually runs short of highly specialized and much-needed human capital—and, as noted above, that’s exactly what was occurring in the Big Three supply chain during the 1990s.

In sum, we need to be careful not to conclude that a slow comeuppance for complacency is the same thing as no comeuppance at all. Indeed, it’s possible that our current policies are enabling one generation of lawyers to prosper at the expense of those who follow, effectively running the well dry. A truly learned profession, of course, would see this coming.

Regarding recent automotive history, there is another parallel that warrants our attention. Further, it also centers on the primacy of human capital. What revitalized the U.S. automotive industry was the eventual wholesale adoption of lean production methods (Kaizen, discussed above), which required factory workers up and down the supply chain to learn and practice team-based continuous improvement. The legal industry parallel is the need for allied professionals from multiple disciplines to acquire sufficient T-shaped skills to enable high-quality collaboration. See, e.g., Post 221 (legal technologist Ken Jones discussing quality of collaboration necessary to create high-quality legal software).

For the U.S. auto industry, this slow and gradual human capital pivot began in the early 1990s after the publication of James Womack’s The Machine the Changed the World (1990), which is likely the most influential auto industry book ever published. See Post 195 (Dan Currell distilling four lessons from Womack’s book that apply to today’s legal market).

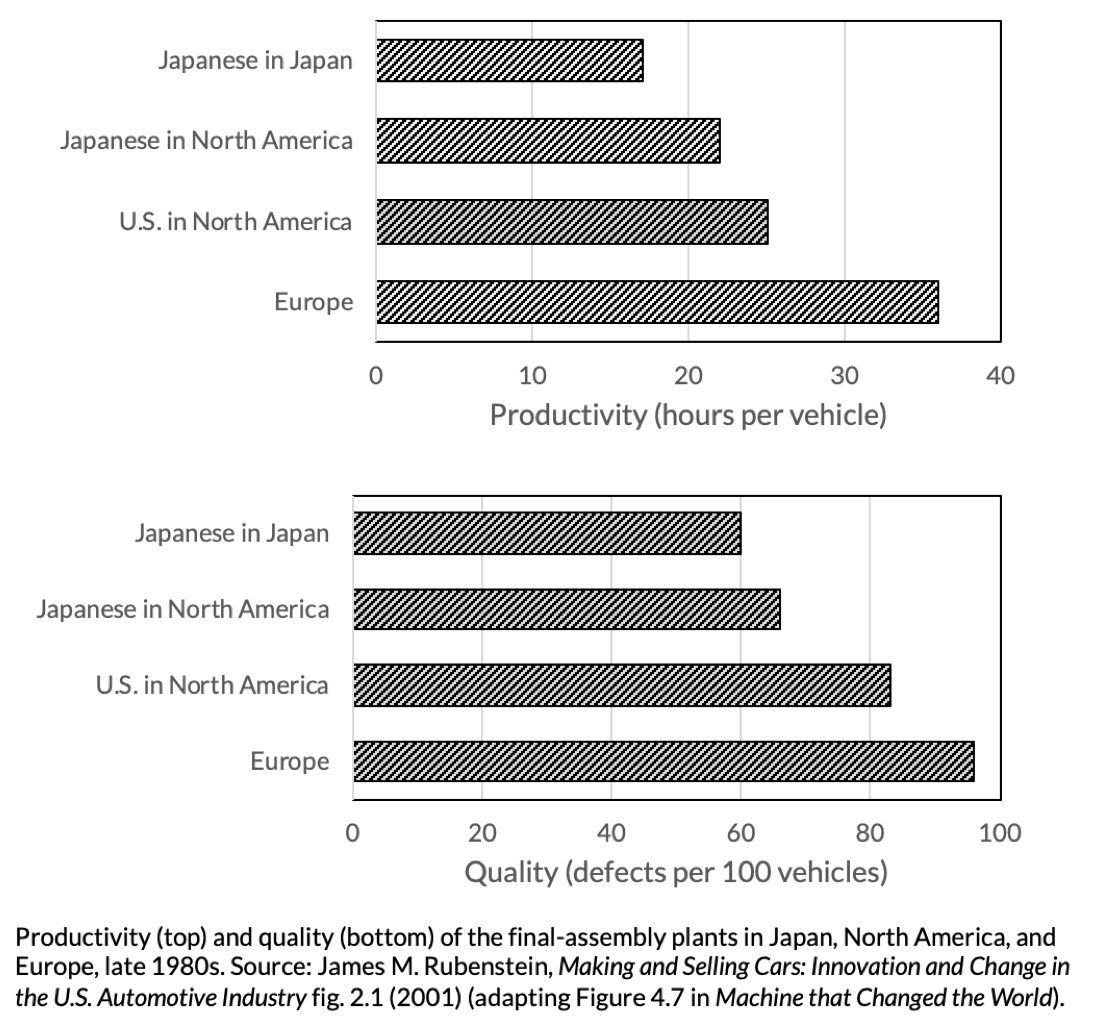

The book was the culmination of a five-year study conducted by the MIT International Motor Vehicle Program (IMVP), which was paid for by U.S. and European carmakers and various government agencies in North American and Europe. According to automotive historian James Rubenstein, the most incontrovertible piece of evidence in the book “was buried in the first two lines of a table labeled ‘Figure 4.7,'” which summarized productivity and quality data by location and type of ownership (Japanese, US, European). See James M. Rubenstein, Making and Selling Car: Innovation and Change in the U.S. Automotive Industry at 33 (2001).

What Table 4.7 communicated was the extraordinary power of lean production methods. Below is a graphic drawn from Professor Rubenstein’s book:

Let’s face it—when you can make a much better car much faster than your competitors, that’s pretty much the ballgame.

What’s happened to the global car industry over the last 20 years is nothing short of extraordinary. In my presentations on the legal industry (and depending upon the audience’s tolerance for manufacturing metaphors), I sometimes include the slide below, which shows three Henderson family cars: a 1997 Dodge Caravan, which we bought shortly after my daughter Lauren was born; a 2003 VW Passat, which I bought for my spouse when we moved to Bloomington; and a 2014 Honda Accord, which we bought when Lauren inherited the Passat at age 17.

What do all these cars have in common besides four doors and four wheels? Remarkably, they were all bought new for $23,000, despite the fact that each model came with numerous additional safety, reliability, and luxury features. Further, as the cost of these better cars remained flat over a 17-year period, my income increased substantially. As a result, the auto industry, through its massive productivity gains, was making me, and many other global consumers, wealthier.

There’s an uncomfortable flip side to this, however. During this same period, the two industries where I earn my living—legal services and higher education—have increased in cost much faster than inflation. See Post 042 (presenting data). Although lawyers serving wealthy corporations continue to prosper (and to be clear, this is a very large group), the PeopleLaw sector continues a very serious downward slide. See, e.g., Post 037 (presenting data). Likewise, law graduates, particularly those from historically disadvantaged groups, are being loaded with crushing debt. See, e.g., Post 182 (presenting data).

The only way to reverse these trends, of course, is to find ways to dramatically improve the cost and quality of legal service delivery–which brings us to the market map at the very top of this post. Virtually all of these companies have fashioned a product or service that accomplishes more for less. Likewise, all of them leverage insights for various allied professions and emphasize the importance of legal professionals with T-shaped skills. See Post 126 (discussing diverse human capital needed for one-to-many legal solutions); Post 221 (software engineer discussing the massive proliferation of legal technology solutions).

The upskilling is an essential precondition of the nascent one-to-many legal services market—the one that is most reminiscent of the auto industry circa 1905.

B. Early auto industry history (1890s to 1940s)

To remind readers, the story of the early auto industry is one of mass entry of starry-eyed entrepreneurs followed by a period of brutal winnowing that ends in industry consolidation. With very few exceptions, those who created this dynamic new industry did not become rich. Further, one of my primary claims is that this is our future and something we ought to embrace.

Historian Sigur Whitaker recounts one of America’s earliest encounters with an automobile.

All of a sudden, in 1891, a rudimentary automobile appeared on the streets of Indianapolis, causing great concern among residents. Charles Pierson, a wholesale cigar dealer based in Indianapolis, received a large crate containing a Benz automobile from Germany. The next day Pearson [and his colleagues] … took the car on a spin through downtown Indianapolis … Horses were frightened of the loud noises emanating from the smoke-belching machine. Drivers of carriages fought to control the horses from running away. … Although the total travel that day was only six blocks, the route was filled with mayhem. … [T]he car went through a plate-glass window of the Occidental Hotel at the corner Washington and Illinois Street about a block and a half away and Pearson paid $25 to replace the window. Continuing, it ended up breaking a second plate glass window, this time at the corner of Pennsylvania and Washington streets, and another $25 was spent replacing it.

Sigur E. Whitaker, The Indianapolis Automobile Industry: A History, 1893-1939 at 2 (2018). Undoubtedly, this was a satisfying story for those in the horse carriage trade, as it suggested the utter impracticability of so-called promising technology. Yet, the innovators would continue to tinker.

In 1893, Charles and Frank Duryea of Springfield, Massachusetts built the first successful commercial gas-powered vehicle in the United States. However, like virtually all early car companies, it was not a volume business. By 1896, they had sold a total of twelve vehicles. See Alan Naldrett, Lost Car Companies of Detroit at 11 (2016).

By 1900, the nascent auto industry was divided into three segments, with steam-powered vehicles in first place (40% of the market), followed by electric (38%), followed by gas-powered (22%). The trouble with steam, however, was that the cars took a long time to warm up. In addition, drivers and passengers were at serious risk of being scalded to death. Likewise, electric cars had the same problems as today–a very limited travel range. Thus, despite its cost and complexity, gas-powered vehicles soon proved to be the market favorite. Id.

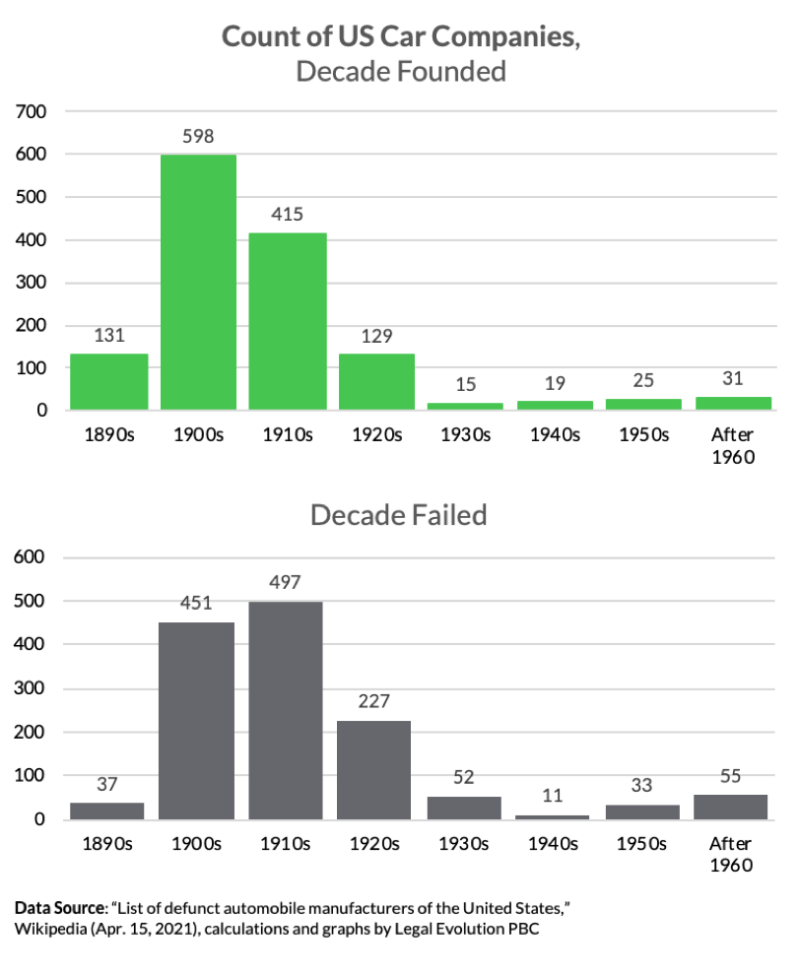

Among early entrants to the U.S. auto industry, it’s hard to overstate the volume and magnitude of dashed ambition. Fortunately, Wikipedia maintains a page of defunct US car manufacturers in the United States. Drawing upon these data, below are two charts that compare the decade of founding of car companies with the decade of failure.

In seeing the above carnage, I am reminded of a conversation I had several years ago with John Suh, who was then CEO of LegalZoom. Because LegalZoom was enjoying significant growth in both revenues and profits, Suh hired an investment bank to scout for potential acquisitions. What came back, however, was a market report that showed a NewLaw and Legaltech landscape that was struggling to attain significant revenue, much less profit. In essence, there was almost nothing worth buying.

In my view, today’s legal industry is akin to the auto industry during the first two decades of the 20th century: literally thousands of legal entrepreneurs who see new and better ways to leverage data, process, design, and technology to solve various types of legal problems or to improve the delivery of legal services.

What the vast majority of these founders have in their minds is what Geoffrey Moore calls the “generic product”—some good or service that is better, faster, and cheaper than the status quo. What is commercially viable, however, is a “whole product solution,” which identifies and anticipates all the challenges created by switching a mode of production. See Post 024 (discussing Moore and his seminal book, Crossing the Chasm (1991)). In the case of automobiles, this includes nettlesome issues such as warranties, replacement parts, repairs and service, the ability to finance, the ability to sell, the availability and cost of fuel and insurance, etc.

Unfortunately, very few innovators have the commercial savvy and dogged determination to solve all these seemingly ancillary problems that crop up around their breakthrough product or solution. See Post 024 (“Building a whole product is less a technical feat than an extended exercise in commercial empathy.”); Post 008 (“Adopting the perspective of the end-user is an exercise in empathy. This can be very difficult for the innovator, who is often deeply immersed in the technical workings of the project. He or she is at grave risk of falling in love with features that are of little practical value to the target end-user.”).

Among the early carmakers, the most farsighted was Henry Ford, who understood that a combination of cost and quality could give rise to a massive enterprise that had the financial resources to eventually solve most of the worries of the average consumer, albeit William “Billy” Durant, the founder of General Motors, was a creative and formidable competitor.

According to technology historian John Rae, Henry Ford’s primacy in the U.S. auto industry came down to three factors that were personal to Ford:

First, Henry Ford clearly had the concept of a “car for the great multitude” almost as soon as he became interested in horseless carriages. He was not alone in having the idea; he was alone in sticking to it with grim persistence, through several fall starts, until he brought it to fruition. [The Ford Motor Company was Ford’s third car company.]

Second, he avoided the error of competitors, which was to start off by trying to design a vehicle that could be built cheaply. Ford sensed that the first essential was to design an automobile that could meet the requirements of a “car for the great multitude” — durability, simplicity, and ease of operation and maintenance. When he found this design in the model T, then he tackled the problem of producing it cheaply.

Third, the responsibility for the key decisions — the concentration of a single standard design, the model T of happy memory, and the adoption of a moving assembly line — was Ford’s and Ford’s alone. It makes no difference who thought of them first. Henry Ford was the president of the company and its majority stockholder. If these decisions proved wrong, his neck was out further than anyone else’s; with his previous track record of failure, his career in the automotive industry would have been irretrievably finished.

See Rae, supra at 7 (paragraph breaks added for clarity).

One of Ford’s (and the industry’s) biggest breaks was a patent infringement ruling in 1911 that freed Ford and other automakers from onerous royalty payments for the Selden patent (U.S. patent number 549,160), which purportedly covered “the application of the compression gas engine to … horseless carriage use.” See Rubenstein, supra at 11. The narrow interpretation on the Selden patent came just a few days after Ford’s bold decision to construct the Highland Park assembly plant, which would give Ford a massive advantage in terms of both volume and cost of production. Imagine the difficulty of competing against Henry Ford, whose slashing of car prices had the seemingly anomalous effect of simultaneously increasing both gross revenue and profits. Whereas Ford’s competitors had focused on more upscale consumers, which in theory created room for a higher profit margin, Ford could see the enormous potential of using economies of scale to tap into a much larger, but latent, mass market.

Regarding the focus on the high-end market, there are both significant parallels and dissimilarities between the early 20th-century auto industry and today’s legal market. Obviously, the targeting of more affluent clientele is an area of commonality. For lawyers and law firms, the upmarket focus is viewed as a commercial imperative, as fewer and fewer ordinary people can afford legal services. See Post 037.

Yet, here is a key difference: cars are purchased and consumed by people, whereas corporations are the primary buyer of legal services–more than 75% of the market. See also Post 037. As discussed in Part II, this has enormous implications for how one-to-many products and services get marketed and sold, adding a level of complexity that is missing in a pure B2C market.

Below is a graphic that summarizes a full century of competition in the U.S. auto industry.

Regarding this graphic, below I offer two observations and ask how they might apply to the emerging one-to-many legal industry:

Winnowing. During the first three decades of the 20th century, the number of car makers winnowed from nearly 2,000 to a mere seven—seven!—with any meaningful market share. Further, two companies, GM and Ford, accounted for nearly 80% of total car production.

This winnowing occurred because of the enormous competitive advantages that accrue through economies of scale and scope. When the national economy hit the skids in the early 1920s, Henry Ford could slash prices, thus keeping his factories open; in contrast, his competitors, including the “Little Four” (Hudson, Nash, Packard, and Studebaker), had to idle their plants, ceding market share to Ford and creating turmoil within their workforce.

Ford and GM also had the resources to deal with the competition of their own creation–the used car market, partially solving it by exporting nearly a third of all trade-ins and selling much of the rest for scrap. See Whitaker, supra, at 210 (“Between 1922 in 1923, 1,450,000 cars were sold for scrap and another 700,000 were exported. Basically, the industry was saturated.”).

In the mid-1950s, Hudson and Nash merged to become the American Motor Company (AMC), the company that catapulted George Romney, Mitt’s father, to the governorship of Michigan. AMC would hang on until 1988. Studebaker and Packard also merged in the mid-1950s but would cease production a decade later. That is how the field winnowed to the Big Three.

Very long bake time. Although 1910s and 1920s were a period of enormous growth in the auto industry, the largest and most lucrative period of growth would not occur until after World War II—roughly a half-century after nearly 2,000 car companies risked so much to get into the game. How many of these idealistic entrepreneurs were still around to share in the spoils?

Perhaps the following axiom is true: the more crowded and chaotic the marketplace, the longer the bake time (i.e., the time needed to produce a stable, profitable operating company). This is true, in part, because a crowded, chaotic marketplace is a frightening place for prospective buyers, as they lack the time and expertise to make buying decisions with confidence. In the case of the auto industry, the bake time was roughly six decades, or 3+ generations of leaders and managers.

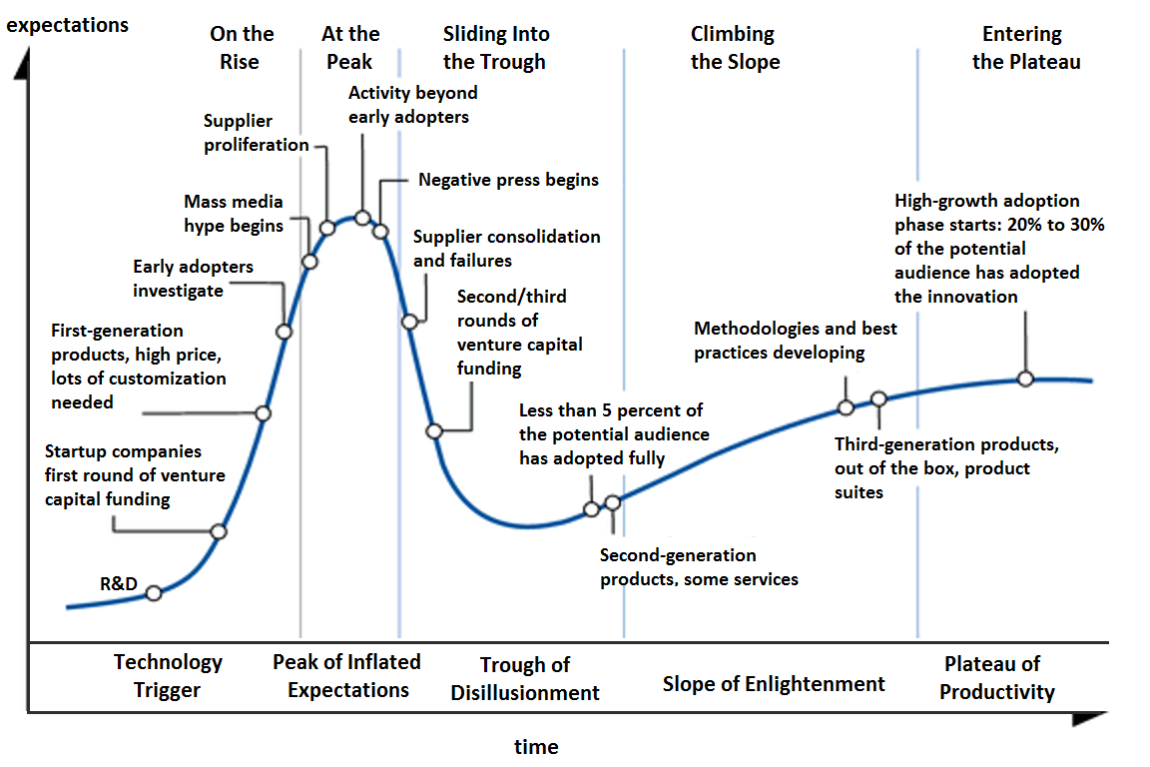

In my view, the history of the early auto industry enables us to better appreciate and respect the wisdom embedded in the Gartner Hype Cycle—the slope of enlightenment is arrived at through immense risk taken by those who go first, or even second or third.

At the beginning of this essay, I suggested that today’s one-to-many legal marketplace is akin to the auto industry circa 1905. All 1900+ carmakers were right that cars were the future of US transportation. But they were wrong that consumers would be buying their cars.

If my analysis is correct, why would any sane lawyer, entrepreneur, or funder bet on the one-to-many legal sector? In my view, an answer is provided by technology historian John Rae, who studied the dozen or so Michigan entrepreneurs who made Detroit the center of the auto industry:

They were a diverse group, but they had one thing in common. They became utterly dedicated to the manufacture of motor vehicles, to the point where they seem to have preferred to go broke making automobiles than to get rich doing anything else.

See Rae, supra at 6.

It is noteworthy that the Ford Motor Company was Henry Ford’s third car company. His first company, the Detroit Automobile Company, closed in 1900 after making a few dozen vehicles. His second company, the Henry Ford Company, also failed within a year, with its residue becoming (under different leadership) the Cadillac Automobile Company, which would eventually become part of General Motors. In 1903, Ford formed the Ford Motor Company with a vision “to build the best-selling low-priced model,” though his principal financial backer preferred more expensive cars. Ultimately, this disagreement did not matter because Ford, having learned from his prior failures, made sure he was the majority stockholder. See Rubenstein, supra, at 9.

When I reflect on Ford’s founding story, I can’t help but think of Liam Brown’s founding of Integreon, which he left after a disagreement with his venture capital backers. In turn, Liam founded Elevate Services, a company he bootstrapped—so he could stay in control—thanks to his payout from Integreon. See Post 010 (discussing Brown’s career history); see also Post 088 (Liam Brown discussing Elevate’s acquisition strategy).

Likewise, the Henry Ford story also reminds me of Eric Elfman, the serial legaltech entrepreneur. In 1998, fresh out of business school, Elfman founded DataCert, an e-billing company that would sell to Wolters Kluwer nearly 16 years later. According to Elfman, he leveraged all the missteps and frustrations of Datacert to create Onit, which uses a “low code” programming approach to streamline and automate a host of administrative tasks, including e-billing. In 2017, Elfman visited my Innovation Diffusion class at Northwestern Law, remarking that making and selling enterprise software (what he did at Datacert) “was a game he could not win.” See Post 041.

Surviving and thriving in today’s one-to-many legal solutions market is not for the faint of heart. Every day is a continuous learning process of bolting together offerings that solve real problems—not tomorrow, but today! Further, this daunting task must always be accomplished without running out of cash.

So why do something this hard? Because getting wealthy is, at best, a second-order effect of doing what innovators are naturally compelled to do, which is to innovate solutions to difficult problems. For founders and their teams of fellow innovators, a huge part of the attraction is making the practice of law demonstrably better for all stakeholders — i.e., seeing that the idea stuck in your head actually works.

By conventional standards, virtually every professional working in the emerging one-to-many legal sector is choosing a risky and seemingly imprudent career path. Yet, they are functionally “getting paid” through the act of innovation. Over the full arc of their careers, most of these innovators will do fine. And fortunately, a few will get extraordinarily rich.

II. Dissimilarities and Limitations of Auto Industry Metaphor

In Part I above, I made the case that two parts of auto industry history provide the best metaphor to explain the present and future of the legal industry. The more recent history of incumbency and complacency of the Big Three provides a close analog to the attitudes that pervade BigLaw and many large corporate legal departments. Further, the cure to this complacency is going to take us down a road that is very similar to lean production. See Part I.A, supra. The potential of this new era is now obvious to literally thousands of legal innovators. Hence, the crowded and chaotic one-to-many market map that begins this post. In this respect, today’s legal market is akin to Detroit in 1905. See Part I.B, supra.

In Part II, which is blessedly much shorter, I sketch out the dissimilarities and limitations of the auto industry metaphor, hoping to provide insight for the many legal innovators navigating these waters.

1. Law is not a single commodity; unlike cars, it solves a multitude of problems.

The above statement is true. Although quite large in the aggregate, the legal sector is both smaller and more variegated than the auto (or personal transport) business. That said, one-to-many is perhaps best characterized as a methodology (data, carefully designed workflows, automation, validation, quality control) and/or a set of features (more predictable, more affordable, more convenient). We have a crowded, chaotic market map akin to Detroit in 1905 because the value of this methodology/set of features is both obvious and seductive to a huge number of legal innovators. Thus, the auto industry metaphor still holds.

2. Law requires gold-collar knowledge workers, not blue-collar production workers

The above statement is true but not as limiting as some might believe. In the 1890s and 1910s, virtually the entire auto industry relied upon craft production, which is skilled craftman building individual cars in one stationary place by hand. This was expensive on two levels: its required highly skilled and relatively rare human capital; and it was very labor-intensive to build a single car. Henry Ford substantially solved this problem through assembly-line production, albeit his approach gave rise to a new kind of knowledge worker: the industrial engineer, who designed and optimized (or attempted to optimize) the production process. Although the assembly-line approach relied upon deskilling the production process, the next major breakthrough was lean production, which required a significant upskilling.

Here is the relevant timeline:

T1: Craft Production => T2: Assembly Line => T3: Lean Production

A huge portion of the legal profession is functionally stuck in craft production mode, with all the attendant challenges of cost and quality. This is the inescapable conclusion of virtually all of Jason Barnwell’s posts on Legal Evolution. See, e.g., Post 210 (discussing law’s “wicked problems”, which require multidisciplinary perspectives to solve); Post 159 (analogizing much of legal production to a chaotic, disorganized factory); Post 143 (discussing the reengineering of legal at Microsoft); Post 080 (discussing surfeit of work in law firms that could have been automated many years ago if incentives were different).

Because law is different than making automobiles, we cannot solve our challenges through an assembly line process. That said, I would posit that the human capital strategies for one-to-many legal solutions are profoundly collaborative, just like lean production.

Consider the progression in the following modes of production: Craft production (no collaboration) < industrial engineer/unskilled labor (no collaboration) < lean production (blue-collar collaboration) < one-to-many (gold-collar collaboration).

3. Unlike automobiles, the legal sector is primarily a B2B sector

The above statement is true and is the place where the auto industry metaphor has the most serious slippage.

As noted in earlier Legal Evolution posts, the legal sector can be functionally divided into two “hemispheres”: one that serves people and the other that serves organizational clients. See Post 007 (discussing theory and thus “why consumer market is different”); Post 037 (discussing origins and implications of Heinz-Laumann two-hemisphere framework); Post 126 (discussing how the evolution of one-to-many legal solutions is destined to vary based on hemispheres). Further, over the last half-century, the PeopleLaw sphere, which is B2C like the auto industry, has entered a period of decline. This is because most ordinary people with legal problems connected to common life challenges, such as housing, healthcare, employment, insolvency, etc., struggle to afford a lawyer.

The atrophying of the PeopleLaw sector has caused more or more lawyers and law school graduates to focus on business clientele. As of 2012, businesses accounted for more than three out of every four dollars spent on U.S. legal services. See Post 037. The much smaller PeopleLaw sector is hamstrung by Rule 5.4 of the Model Rules of Professional Conduct, which preclude lawyers from co-venturing with the types of allied professionals who are integral to the creation of one-to-many legal solutions. Although Rule 5.4 nominally applies to lawyers serving organizational clients, the legal profession has essentially given an exemption to nonlawyer ownership if the entity is selling to businesses with an in-house lawyer, who in theory “supervises” the legal work on behalf of their organizational client. See William Henderson, Legal Market Landscape Report at 25-26 (State Bar of California, July 2018) (collecting and summarizing relevant legal analyses); Post 053 (discussing how UnitedLex, which has nonlawyer ownership, set up ULX Partners to avoid violating Rule 5.4).

Below is a human capital map for the full range of the one-to-many legal services market, which originally appeared in Post 126:

Although the substantial B2B/L2L nature of the legal market circa 2021 is very different than the auto industry, that difference only reinforces and makes more likely a very long bake time for the emerging one-to-many legal marketplace. This is because the buy decisions are disproportionately made by groups of lawyers. See Post 008 (discussing how group-based decision-making slows down the rate of adoption of innovation); see also Gabrielle Orum Hernández, “The 11 Legal Tech Startups Currently Backed by Y Combinator,” Law.com, Sept. 2, 2016 (discussing preference of Y-Combinator to fund legaltech start-ups selling to consumers rather by businesses).

4. Varied nature of the legal industry makes economies of scale very difficult to achieve.

The above statement is true. Yet, very difficult is not the same as impossible. Further, some recent Legaltech evaluations suggest that funders are undeterred. See, e.g., “Rocket Lawyer Obtains Further Funding Injection,” Crily Legal News, Apr. 23, 2021 (reporting $223M capital round); Miriam Gottfried, “Silver Lake to Invest in Legal-and-Compliance Software Firm Relativity,” Wall Street Journal, Mar. 18, 2021 (reporting $3.6B evaluation with Silver Lake a new majority shareholder); Jason Tashea, “Clio closes blockbuster investment for $250M; CEO says it’s a ‘historic moment’,” ABA Journal, Sept 6, 2019 (reporting $250M investment); Robert Ambrogi, “LegalZoom Zooms Into $500 Million Secondary Investment,” LawSites, July 31, 2018 (announcing $500M equity round in LegalZoom).

It is noteworthy that three out of four of these Legaltech deals cater to either the B2C market (LegalZoom and Rocket Lawyer) or sell to lawyers serving the B2C market (Clio). But the fourth and the largest, by a wide margin (Relativity), is focused on the e-discovery and compliance problems of large organizational clients. What’s the takeaway here? That one-to-many legal products and solutions can generate vastly more wealth than selling traditional one-to-one consultative legal services.

Despite clear market evidence, many lawyers and legal educators struggle to see the importance and potential of the rapidly expanding one-to-many legal market, in part because it requires us to see beyond markers of prestige and hierarchy we’ve worked so hard to attain. As such, our expectations of change are heavily anchored in the changes, or the pace of change, inside BigLaw, large corporate legal departments, the federal judiciary, and elite law schools.

These institutions will be the last to change, primarily because the formal practice of law (i.e., giving bespoke legal advice) to large corporate clients is destined to remain a viable path for legal technicians to earn an excellent living. See Post 071 (bespoke legal advice for a changing economy and society is Type 0 innovation; Type 1 innovation, in contrast, is about creating one-to-many service deliver products and solutions). Ironically, more good will be accomplished, and more wealth will be created, for those who can resist the pull of these well-worn and established paths.

It is true that for BigLaw, economies of scale are not possible without attaining significant market share and that is not possible under the existing conflict rules. However, it’s only the last part of the legal service production process—the dispensing of client-specific legal advice—that creates an attorney-client relationship. When the production process is decomposed into pieces and parts, the door is opened to scalable one-to-many products and solutions.

Although corporate lawyers are well-positioned to identify one-to-many opportunities, as they can see recurring patterns within the firm and across clients, they are poorly equipped to exploit them. This is true for at least two reasons:

- The required human capital has an extraordinarily high opportunity cost. Thus, building a legal product is competing against the sale of additional billable hours to clients, which partners view as a sure thing. But see Post 126 (discussing case of Eric Wood, who was taken off the billable hour while an associate at Chapman and Cutler to develop technology solutions and subsequently became an equity partner).

- Maximizing the value of a one-to-many solution requires a firm to sell and market far beyond its existing client base. Further, a substantial number of partners will worry that such a product will cannibalize existing service offerings. Thus, within a crowded market, these dynamics create a recipe for chronically under-resourced product development, marketing, and sales efforts. Cf. Post 072 (discussing PartnerVine model, which attempts to solve this problem by creating a common portal for law firms and legal service providers to sell their legal products).

What is confusing to so many traditional legal services insiders is that elite law firms could struggle to effectively play their superior hand, as they have access to clients, end-users, and financial resources. However, let’s not confuse slow diffusion of the one-to-many approach within law firms with no diffusion. See, e.g., Post 213 (Zach Abramowitz arguing that law firm legal tech is finally gaining significant traction).

In summary, the revolution predicted by Richard Susskind is well underway. What is left, however, is tremendous uncertainty around the timing and pathways of various types of one-to-many legal innovations.

Conclusion

Akin to the auto industry in the early 20th century, the one-to-many legal market marketplace is crowded and chaotic because an entire generation of legal innovators can now see in their heads the dynamism and potential of a new way of practicing law. What they do not see, however, just like the original auto entrepreneurs, are the many challenges that must be resolved in order for their one-to-many offering to attain widespread adoption.

To the extent that the law is different than cars, these differences all cut in the direction of longer bake times for law. Thus, just like the auto industry in 1905, the full potential of the one-to-many legal marketplace will likely take one or more generations to unfold. Fortunately, for many legal innovators, the satisfaction of improving the practice of law for clients and other end-users is often its own reward, making the long and arduous journey worthy of our professional dedication.